Corporate Investment Review for 215996079, 645096350, 526270700, 609090909, 621125209, 120208399

The Corporate Investment Review for entities 215996079, 645096350, 526270700, 609090909, 621125209, and 120208399 provides a critical examination of their financial performance, investment strategies, and market dynamics. By analyzing financial ratios and cash flow metrics, stakeholders can gain insights into operational effectiveness. This analysis also highlights potential challenges and opportunities in the current economic landscape, prompting a closer look at adaptive investment strategies that could optimize returns. What lies ahead for these entities in this shifting environment?

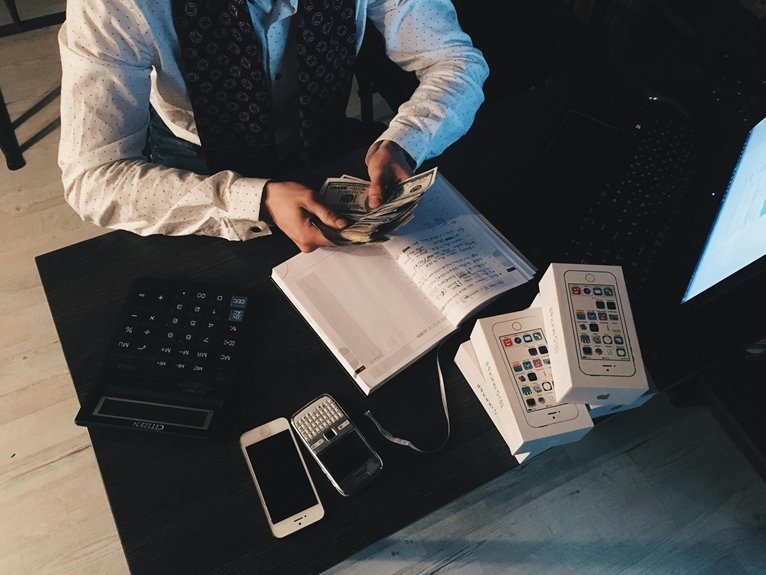

Financial Performance Analysis

Financial performance analysis serves as a critical lens through which stakeholders can evaluate a company’s operational efficiency and profitability.

By examining financial ratios, they can assess revenue growth, profit margins, and cash flow. Effective expense management and optimal asset utilization further contribute to understanding overall financial health.

This analysis empowers stakeholders to make informed decisions, promoting freedom in investment choices and strategic planning.

Investment Strategies Overview

What factors should investors consider when formulating their investment strategies? A thorough risk assessment is crucial, allowing investors to gauge potential volatility and returns.

Additionally, effective asset allocation, balancing equities, fixed income, and alternative investments, ensures diversification.

Market Trends and Insights

How do prevailing economic conditions influence market trends and investor sentiment?

Current market dynamics reveal a direct correlation between economic indicators and consumer behavior. As inflation fluctuates, purchasing power shifts, impacting investment strategies.

Investors increasingly analyze these patterns, seeking opportunities aligned with evolving consumer preferences. Understanding these insights is crucial for navigating the complexities of the market landscape, fostering informed decision-making amidst uncertainty.

Challenges and Opportunities Ahead

As economic uncertainties persist, businesses encounter a dual landscape of challenges and opportunities that demand strategic navigation.

Effective risk management becomes crucial, enabling organizations to mitigate threats while capitalizing on growth potential.

Conclusion

In conclusion, the corporate investment review reveals a thrilling world where numbers dance and ratios sing—a veritable carnival for financial enthusiasts. While entities 215996079 and friends juggle cash flows like circus performers, the ever-looming economic uncertainties serve as the uninvited clown, ready to slip on a banana peel at any moment. Stakeholders must embrace the delicate art of balancing risk and return, lest they find themselves spectators in this grand show of market trends and investment strategies.